Amazon's Global Playbook: How It's Expanding Across Markets

Amazon’s Origin and Global Vision

What began in a Seattle garage in 1994 has become a global powerhouse. Amazon started as an online bookstore under Jeff Bezos’ vision to be "Earth's most customer-centric company." Today, it operates in over 20 countries and generates 25-30% of its total revenue from international markets.

But Amazon's global rise isn't a story of luck. It’s a product of a methodical playbook that blends strategic timing, infrastructure dominance, and cultural flexibility.

Amazon’s First Global Moves: UK, Germany, Japan

Amazon’s first foray into global markets came early. By 1998, just four years after its U.S. debut, it launched in the UK and Germany. Japan followed in 2000. These markets were chosen deliberately for their robust internet infrastructure, high purchasing power, and efficient delivery networks.

The early lessons were profound:

- In Germany, customers preferred invoice payments.

- In Japan, packaging and gift presentation were crucial.

Instead of pushing American norms, Amazon listened. It customizes user experiences while keeping its core promise intact: low prices, vast selection, and convenience.

Inside Amazon’s Global Expansion Strategy

Over time, Amazon shaped a repeatable model for international growth. Here are the key pillars of its global playbook:

How Amazon Chooses New Markets

Amazon uses a data-driven market scoring system. Criteria include:

- Market size and e-commerce growth potential

- Internet penetration and tech infrastructure

- Competition intensity

- Regulatory complexity

- Logistics readiness

It classifies countries into three tiers:

- Tier 1: Developed markets like Germany, UK, Japan

- Tier 2: High-growth developing markets like India, Brazil, Mexico

- Tier 3: Smaller or gateway markets like Singapore

Amazon’s Step-by-Step Market Entry Playbook

Amazon doesn’t launch everything at once. It scales in phases:

- Digital Beachhead: Starts with books and media.

- Marketplace Expansion: Enables third-party sellers.

- Prime Launch: Offers basic loyalty perks.

- Infrastructure Investment: Builds fulfillment centers and delivery networks.

- Category Rollout: Expands into electronics, apparel, groceries.

- Service Ecosystem: Adds Echo, Alexa, Prime Video, etc.

This sequence helps Amazon minimize upfront risk and adapt based on early market behavior.

Amazon’s Approach to Global-Local Balance

Amazon combines a global tech backbone with hyper-local execution:

What Stays Global:

- Customer obsession

- Fast delivery

- Competitive pricing

- Vast selection

What Gets Localized:

- Payment Options: Cash on delivery in India, Boleto in Brazil, invoice in Germany

- Delivery Models: Bikes in India, lockers in Europe, convenience store pickups in Japan

- Languages/UI: RTL Arabic support, Indian languages, culturally relevant promotions

Amazon walks a fine line between global scale and regional empathy.

How Amazon Localizes Pricing

Amazon adapts its pricing model across regions using five key tactics:

1. Dynamic Pricing Algorithms

Tailored to local demand, elasticity, and competitor rates. In the UK, prices on high-demand items can change every 10 minutes.

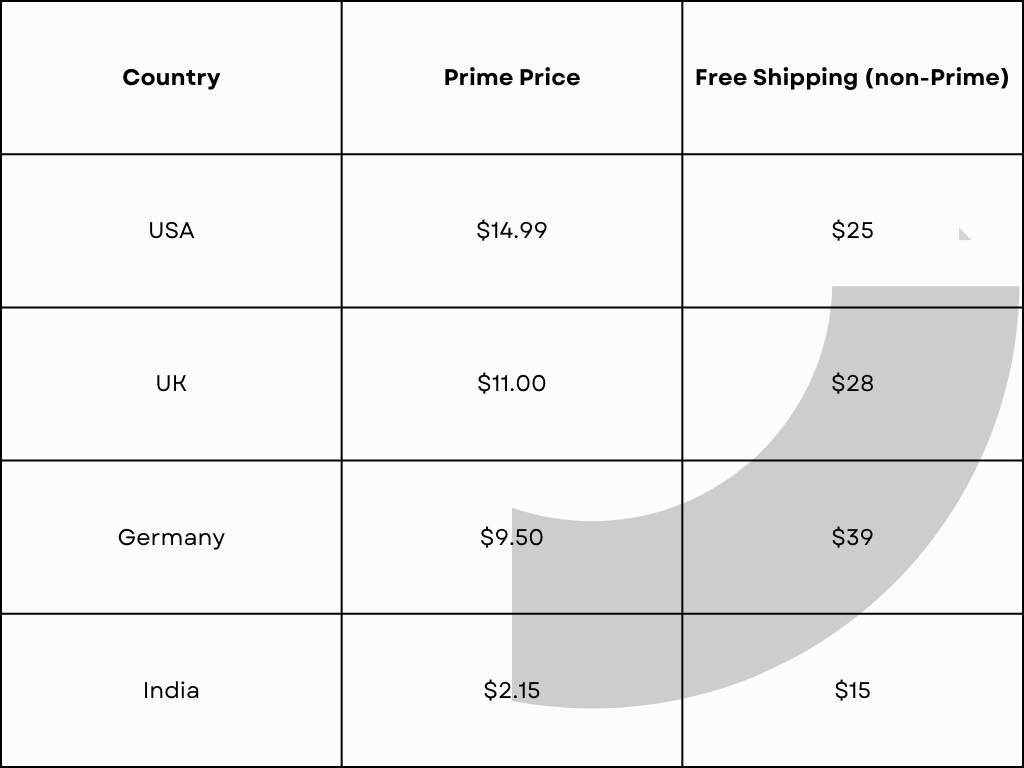

2. Prime Membership Calibration

Prices are set at ~1% of median monthly income:

- U.S.: $14.99

- India: $2.15

- Japan: $4.00

How SurgeGrowth Makes Pricing Research Easier

Our platform is designed to simplify the pricing research process, offering valuable features for businesses:

- Pre-Built Pricing Indexes: Set localized pricing with ease, eliminating the need for extensive A/B testing in all geographies.

- Custom Index Creation: Modify pre-built indexes based on your previous learnings and tailor them to your business needs.

- Bulk Localization: Import existing App Store and Play Store products and localize them all in bulk.

- Quick Setup: Everything is ready within 10-15 minutes of signing up. It’s super easy to use and requires no developers.

4. Category Margin Strategy

Strategically set by country to match average cart sizes and consumer behavior.

4. Category Margin Strategy

Thin margins on price-sensitive items (like electronics in India), higher margins on private label household goods.

5. Tax-Optimized Pricing

Amazon navigates VAT/GST differences strategically, sometimes absorbing tax hikes to maintain pricing psychology.

Amazon’s Investment in Global Logistics

Infrastructure is Amazon’s core competitive moat. In each region, it invests in:

- Fulfillment Centers: Location optimized by demand density and transport access

- Delivery Fleets: Motorbikes in India, vans in Europe, air cargo in Brazil

- AWS Regions: Cloud infrastructure that powers its marketplace and local businesses

Example: In India, Amazon operates over 60 fulfillment centers. In Europe, it reaches 95% of the population with next-day delivery.

How Prime Powers Amazon’s Global Retention

Prime is customized for each market:

- India: ₹179/month, bundled with mobile data plans

- Japan: ¥600/month, includes manga and anime

- UK: Integrated with Deliveroo

Amazon also invests $1B+ annually in local Prime Video productions and aligns Prime Day with local shopping festivals.

Amazon’s Wins and Losses: India vs. China

China: The Miss

Amazon entered China in 2004 but exited in 2019 after peaking at just 1.3% market share. Alibaba and JD.com offered superior local customization and supplier ecosystems.

India: The Make

In India since 2013, Amazon committed over $7.5B. Key local strategies:

- "I Have Space" partnerships with 28K+ local stores

- Amazon Easy kiosks for assisted shopping

- Custom delivery vehicles for narrow roads

- Emphasis on cash and digital wallet payments

India remains one of Amazon’s highest-priority markets

Amazon’s M&A Strategy: The Souq.com Example

In the Middle East, Amazon took a different route. Instead of building from scratch, it acquired Souq.com for $580M in 2017.

Souq gave Amazon instant reach in UAE, Saudi Arabia, and Egypt. After a two-year transition, Souq was fully rebranded as Amazon.ae.

Amazon’s Playbook in Latin America

Amazon entered Brazil in 2012 (digital goods) and Mexico in 2013. Local adaptations included:

- Credit Installments: Up to 12 months interest-free

- Logistics Partnerships: 8,000+ pickup points

- Air Freight Hubs: Campinas and Mexico City

- Localized Content: 20+ Prime Video originals in Brazil

Despite this, competition remains fierce from regional giant MercadoLibre.

How Amazon Handles Global Regulations

Amazon has had to adjust operations based on legal frameworks:

- Europe: Faced antitrust probes, changed marketplace data practices

- India: Operates as a pure marketplace due to FDI restrictions

- Tax Settlements: Paid millions in France and Italy while updating its tax structure

Flexibility without abandoning core principles is key to Amazon’s regulatory navigation.

What’s Next in Amazon’s Global Growth

1. Deepening in Existing Markets

Expanding from urban hubs into smaller cities in India, Brazil, and Mexico.

2. Africa’s Emerging Opportunity

Starting operations in Nigeria and South Africa, with logistics pilots and AWS cloud zones.

3. Globalizing New Business Models

- Amazon Go stores in the UK

- Healthcare offerings for select markets

- Fintech expansion in emerging economies

6 Takeaways from Amazon’s Expansion Strategy

- Patient Capital: Long-term view wins markets.

- Localized Innovation: Tailored solutions are essential.

- Pricing Intelligence: One-size pricing doesn’t fit all.

- Logistics Dominance: Control over last-mile is key.

- Flexible Playbook: Adjust entry mode to market conditions.

- Learning from Failure: Missteps (like China) inform future wins.

Why Amazon’s “Day 1” Culture Still Wins Globally

Jeff Bezos famously said, "It’s still Day 1 at Amazon."

That mindset—constant innovation, customer obsession, and long-term thinking—is what powers Amazon’s ongoing global rise. It’s not just where Amazon expands that matters, but how.

The result? A blueprint that other global brands can study, adapt, and execute.

If your brand is planning global growth, Amazon’s playbook is a masterclass in doing it right.